Here’s an example, showing a breakdown of Beta’s three main product lines. Yes, the Contribution Margin Ratio is a useful measure of profitability as it indicates how much each sale contributes to covering fixed costs and producing profits. The overarching objective of calculating the contribution margin is to figure out how to improve operating efficiency by lowering each product’s variable costs, which collectively contributes to higher profitability. The Contribution Margin is the incremental profit earned on each unit of product sold, calculated by subtracting direct variable costs from revenue. In the United States, similar labor-saving processes have been developed, such as the ability to order groceries or fast food online and have it ready when the customer arrives. Do these labor-saving processes change the cost structure for the company?

The Evolution of Cost-Volume-Profit Relationships

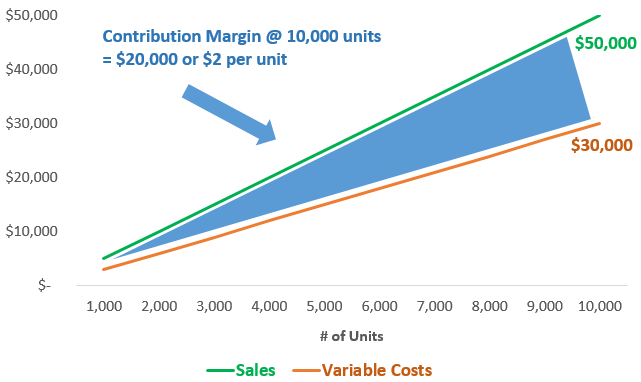

Using the provided data above, we can calculate the price per unit by dividing the total product revenue by the number of products sold. As you can see, contribution margin is an important metric to calculate and keep in mind when determining whether to make or provide a specific product or service. Now, divide the total contribution margin by the number of units sold. Instead of doing contribution margin analyses on whole product lines, it is also helpful to find out just how much every unit sold is bringing into the business.

How do you calculate the weighted average contribution margin?

It helps business owners understand how sales, variable costs and fixed costs all influence operating profit. You’ll often turn to profit margin to determine the worth of your business. It’s an important metric that compares a company’s overall profit to its sales. However, if you want to know how much each product contributes to your bottom line after covering its variable costs, what you need is a contribution margin.

What is the contribution margin ratio formula?

When comparing the two statements, take note of what changed and what remained the same from April to May. To illustrate how this form of income statement can be used, contribution margin income statements for Hicks Manufacturing are shown for the months of April and May. For example, assume that the students are going to lease vans from their university’s motor pool to drive to their conference. A university van will hold eight passengers, at a cost of \(\$200\) per van. If they send one to eight participants, the fixed cost for the van would be \(\$200\). If they send nine to sixteen students, the fixed cost would be \(\$400\) because they will need two vans.

- You will also learn how to plan for changes in selling price or costs, whether a single product, multiple products, or services are involved.

- The contribution margin ratio represents a company’s revenue minus variable costs, divided by its revenue.

- To understand how profitable a business is, many leaders look at profit margin, which measures the total amount by which revenue from sales exceeds costs.

- It provides one way to show the profit potential of a particular product offered by a company and shows the portion of sales that helps to cover the company’s fixed costs.

- Knowing how to calculate contribution margin allows us to move on to calculating the contribution margin ratio.

Break even point (BEP) refers to the activity level at which total revenue equals total cost. Contribution margin is the variable expenses plus some part of fixed costs which is covered. Thus, CM is the variable expense plus profit which will incur if any activity takes place over and above BEP.

We would consider the relevant range to be between one and eight passengers, and the fixed cost in this range would be \(\$200\). If they exceed the initial relevant range, the fixed costs would increase to \(\$400\) for nine to sixteen passengers. More importantly, your company’s contribution margin can tell you how much profit potential a product has after accounting for specific costs. Investors and analysts use the contribution margin to evaluate how efficient the company is at making profits. For example, analysts can calculate the margin per unit sold and use forecast estimates for the upcoming year to calculate the forecasted profit of the company.

However, a general rule of thumb is that a Contribution Margin above 20% is considered good, while anything below 10% is considered to be relatively low. If the company realizes a level of activity of more than 3,000 units, a profit will result; if less, a loss will be incurred. Aside from the uses listed above, the contribution margin’s importance also lies in the fact that it is one of the building blocks of break-even analysis.

Put more simply, a contribution margin tells you how much money every extra sale contributes to your total profits after hitting a specific profitability point. For instance, you can make a pricier version of a general product if you project that it’ll better use your limited resources given your fixed and variable costs. The contribution margin (CM) is the amount of revenue in excess of variable costs. Doing this break-even analysis helps FP&A (financial planning & analysis) teams determine the appropriate sale price for a product, the profitability of a product, and the budget allocation for each project.

This metric is typically used to calculate the break even point of a production process and set the pricing of a product. They also use this to forecast the profits of the budgeted production numbers after the prices have been set. Another common way to look at contribution margin is as a ratio expressed as a percentage.

The contribution margin is computed by using a contribution income statement, a management accounting version of the income statement that has been reformatted to group together a business’s fixed and variable costs. On the other hand, variable tax benefit definition costs are costs that depend on the amount of goods and services a business produces. The more it produces in a given month, the more raw materials it requires. Likewise, a cafe owner needs things like coffee and pastries to sell to visitors.

Leave A Comment