This method of Costing is used in constructional type of industries such as -Buildings, Dams, Roads, Bridges, etc. Under this method, costs are collected, accumulated and ascertained for each job separately. Because, each job normally differs from others as the works are undertaken strictly in accordance with the customers’ specifications.

Most widely used costing methods

Unit Costing – If production is made in different grades, costs are ascertained grade wise. This method is applicable to steel production bricks, mines and flour mills etc. Using ABC, overhead costs are traced to products and services by identifying the resources, activities and their costs and quantities to produce output. Full absorption costing (often simply called absorption costing) is required by generally accepted accounting principles (GAAP) for external reporting.

What Are the Types of Cost Accounting?

Operating costing is adopted by airways railways, road transport companies (goods as well as passengers) hotels, cinema halls, power houses etc. It refers to the determination of cost of operations; how should i record my business transactions the cost unit is the ‘operation’ instead of the process. The per unit cost is arrived at by dividing the cost of an operation by the number of units completed in the operation centre.

Specific Order Costing

Absorption costing is a cost accounting method that includes variable costs (such as direct materials and direct labor) and fixed overhead costs in calculating product costs. The goal of absorption costing is to determine the total cost of producing a specific product, including all the direct and indirect costs involved. The different types of cost accounting include standard costing, activity-based costing, lean accounting, and marginal costing.

In order to assign a cost to a manufactured good, product costing techniques are used. Contrary to other types of accounting, costing operations are carried out by an organization’s internal management. This internal management is not visible to clients or institutions from the outside.

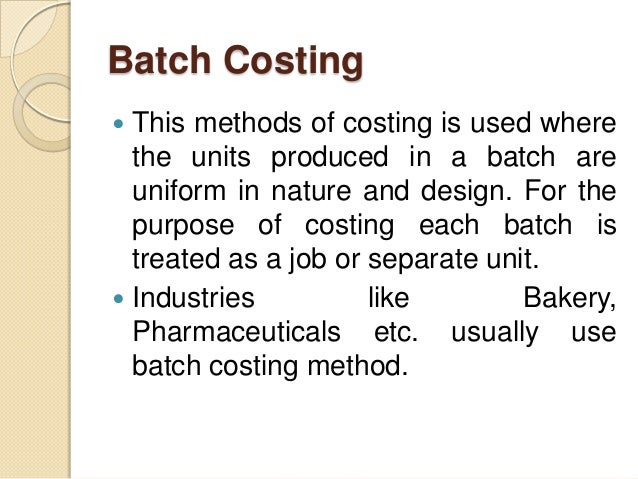

Under this method, a separate account is opened for each individual contract and the same is debited with expenses and credited with Closing Stock of various items and the value of work completed. This method is suitable for activities like construction of a building, construction of ship, etc. The total cost of each batch is determined by aggregating all the expenses related to the specific batch and the cost per unit is determined by dividing the total cost by the number of units in each batch. This method is suitable for activities like printing of visiting cards, preparation of sweets boxes for a function etc.

This method of accounting examines both variable and fixed costs incurred over the course of manufacturing. Costing data is used by businesses to verify that every aspect of production is profitable and effective. The two basic types of costs incurred by businesses are fixed and variable costs. Fixed costs do not vary with output even if the company faces any form of loss, while variable costs do vary according to the percentage of profit yielded that year. In a production facility, labor and material costs are usually variable costs that will increase as the volume of production increases.

- Assembly of these components into one finished unit may require still another method of costing.

- A unit or output (a driver) is used to calculate the cost of each activity consumed during any given period of time.

- Process costing is mainly used in businesses where it can be safely assumed that the cost to produce each order is going to be the same, such as mass-produced food or chemical processing.

- Commerce education is mainly aimed at giving adequate knowledge about the wholesale trade, retail, export trade, import trade, and entire- port trade.

- This is done because each job requires different mark and has separate identity and therefore it becomes essential to analyze and segregate costs according to each job separately.

The importance of cost accounting is a function of the seven points discussed below. It assimilates in itself the functions of costing, which certainly is a narrower term. Further advantages of costing are that it can assist in identifying profitable or unprofitable units and ventures. It reveals the inefficiencies at various levels, and it also helps to identify the exact cause of a decrease or increase in the profit or loss of a business (as a whole or unit-wise, as required). Cost data obtained from costing enable managers to strive toward efficiency for the whole organization. Cost data provide organizational guidelines for various managerial decisions.

It is a method of costing used to ascertain the cost of making a number of similar units of a customised product. Under this method, a batch cost sheet is prepared for each batch of products and all costs related to the specific batch are recorded. Accurate inventory costing is essential for determining the true cost of your products.

Each item of cost (namely, materials, labor, and expenses) is budgeted at the beginning of the period and actual expenses incurred are compared with the budget. Costing also compares the respective costs of different methods, machines, and systems, and it helps in decision-making in this regard. Cost accounting methods are typically not used to determine tax liabilities.

Leave A Comment